- ES Think Tank

- Posts

- The Real Reason Brands Still Pick Sides

The Real Reason Brands Still Pick Sides

April 17, 2025 | Edition #10

Hey there!

Super Bowl LVIII smashed records. College football packed stadiums. And despite some dip, the NBA is still slam dunking. Men’s sports still dominate where it matters most — viewership, cultural influence, and most importantly, providing ROI to sponsors.

In our recent chat with American Eagle Outfitters CMO Craig Brommers, he revealed they are bullish about pivoting toward male athletes and entering fast-rising arenas like F1 and soccer. So, in today’s edition, we dive into why men’s sports are still the gold standard and then jump into quick insights from Brommers.

Reading ES Think Tank for the first time? Subscribe and stay ahead of the trends shaping the sports business industry!

Today’s TLDR:

⛹️♂️ Why brands mustn’t ignore men’s sports

💪 AEO CMO is bullish on F1 & Soccer. And for a reason.

📖 The stories shaping the industry (and the lessons we learned this week)

Let’s dive in. 🚀

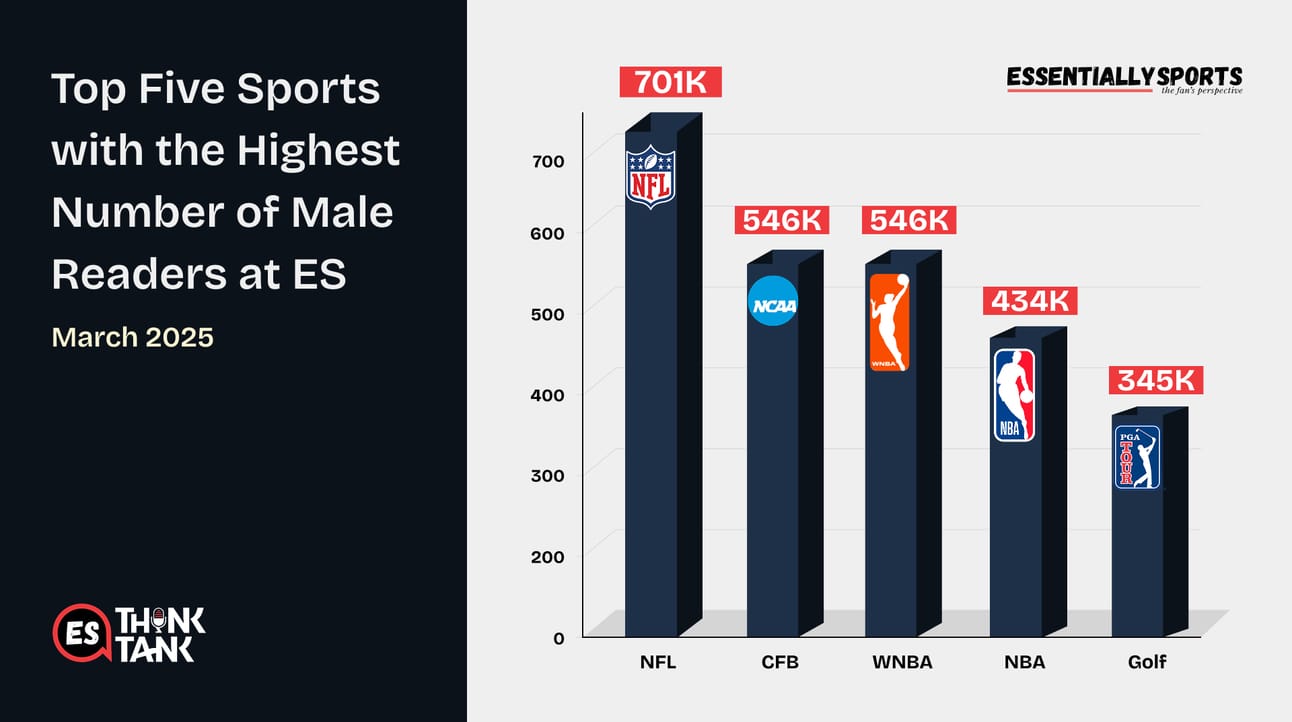

155,317 | New York is home to our biggest male audience, contributing 155,314 readers, or 4.83% of EssentiallySports’ total male reader base. |

Men’s sports continue to command the lion’s share of attention, money, and brand partnerships in 2025. That’s despite the jaw-dropping growth women’s sports have seen in recent years. From record-breaking Super Bowl numbers to massive college football turnouts, the male sports ecosystem remains a powerhouse that brands find hard to stay away from. NFL offers the best case study for this:

🏈 Super Bowl LVIII drew 123M viewers–a record in itself.

📺 Sunday Night Football averaged 21.6 million viewership–the highest since 2015.

🙌 NFL attendance went up to 69,555 in 2024 — the highest in the last 21 years.

The trend is similar across different sports. Even though the NBA has witnessed a viewership slump, the audience base (1.56M) is still larger than the WNBA's (1.2M). Similarly, in College Football, the Georgia vs. Texas match averaged 16.6M viewers across ABC and ESPN, the highest of the season. Whereas, 11.4M people attended MLS matches last season, compared to 2M+ in NWSL.

So, while there has been a spurt in viewership and attendance numbers in women’s sports, men’s sports still enjoy a larger and wider audience base. A key reason why men’s sports still remain a gold standard for brands. Another is the appeal of male athletes to the audience. Superstars like LeBron James and Patrick Mahomes blur the line between sport and pop culture—giving brands diversified exposure and massive fan engagement.

The Business Case for Men’s Sports Collaborations

Brands want more visibility when they partner with a team. While the large audience base is the key, the appeal of male athletes is an added bonus. In 2025, athletes are not just sportspeople. They also don the hats of pop culture icons.

🧢 Think of LeBron James’ pre-game streetwear outfits.

🧥 Or Russell Westbrook’s kilts and oversized fashion wear.

👢 Even better, Odell Beckham Jr, who appears at Paris Fashion Week as well.

So, these athletes' influence transcends the boundaries of sport and crosses the porous border of sport and entertainment. As a brand, having an athlete on your roster who is well-aware of his prowess to ‘move the needle’ is a massive bonus. Sports sponsorship then becomes not just a way to increase brand awareness, but a lead generation tool.

Via contests and special offers, brands can drive sales, directly contributing to the bottom line of the business. While this is certainly true for women’s sports as well, the large audience base in men’s sports offers brands more lucrative opportunities for partnership.

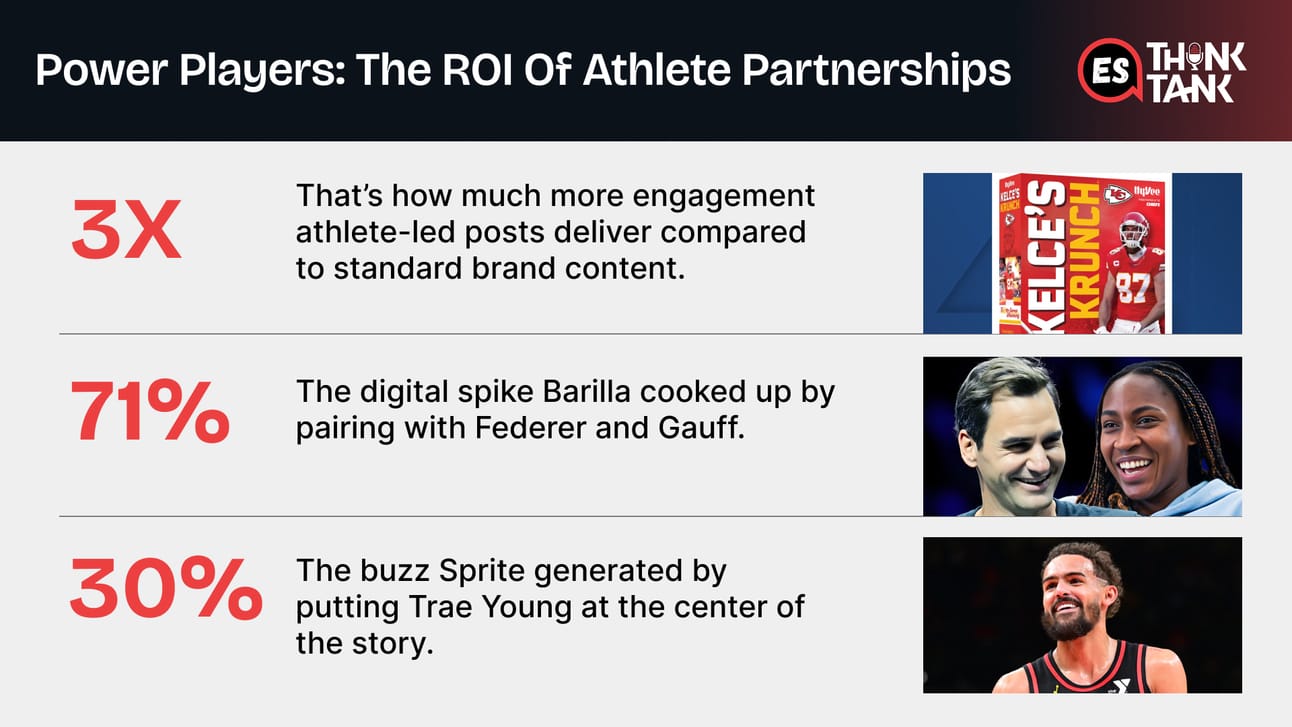

Athletes are cultural catalysts, not just endorsers. As trust in traditional advertising fades, brands are turning to athletes to drive relevance, storytelling, and connection at scale. These partnerships aren’t just about visibility—they’re about authenticity and influence.

With NIL unlocking new doors and athletes owning more of their narrative, the playbook is changing fast. Co-branded drops, equity deals, and content collabs are replacing old-school sponsorships. The smartest brands aren’t renting influence—they’re building with it.

More importantly, men’s sports still enjoy significant coverage time. That effectively means brands have a bigger space to operate and continue with an ongoing storyline, like Nike did with LeBron James.

It allows them to build highly impactful campaigns with minimal risks and also scale up quickly.

Brands rely on merch sales to increase visibility.

Sponsored content via a player’s social media channels amplifies brand awareness.

Male athletes as brand ambassadors is a tried, tested, and proven strategy.

Fans don’t just follow the teams. They worship the player and the value they represent. Which means Tom Brady, LeBron James, and Tiger Woods are all game-changers. So, it’s not a surprise that brands are still relying heavily on male athletes and male sports.

When we sat down with Craig Brommers, CMO of American Eagle Outfitters, he revealed how the brand is doubling down on men’s sports in 2025. Brommers said that in 2025, they are leaning more towards male sports, increasing their investment in male athletes. Not just in established sports like the NFL and NBA, but they want to cross newer frontiers like F1 and Soccer as well.

Do You Think Athletes Make Better Brand Ambassadors Than Influencers? |

Our host, Trey Holder, asked what new leagues and athletes American Eagle Outfitters (AEO) is planning to target. Craig Brommers, AEO’s CMO, didn’t hesitate and said, “I think that we are gonna be more bullish about men’s sports.”

And they’ve already backed that up with action. In late 2024, AEO partnered with Oracle Red Bull Racing to launch an exclusive, limited-edition apparel collection. From racing-inspired streetwear to signature AEO-style casual wear, the collaboration exceeded expectations.

“It blew our mind,” said Brommers. So much so that the partnership is back this season. That move was more than just hype—it was smart business. Formula 1’s popularity has exploded in the U.S. over the last three years. So has Soccer’s.

As Brommers noted, “Soccer, sorry, Football, continues to gain mindshare now in the States. It has for years now. But I think the high water mark is yet to come.” Indeed, that might prove to be just true:

MLS is now the second-most attended soccer league in the world, behind only the English Premier League.

The league pulled in $665 million from sponsorships last season—a 13% YoY increase.

F1 COTA, meanwhile, drew 432K fans in 2024, the third-highest across 24 global circuits.

The Las Vegas Grand Prix generated $934 million in total economic impact.

AEO’s play is clear: double down on the major sports, but don’t sleep on the fast-emerging ones. Indeed, athletes, regardless of the sport they play, are more likely to drive sales for brands. They also draw way higher consumer engagement than a regular brand post. In fact, a survey from Sortlist reveals telling details:

Posts from athletes generate 3x more engagement than standard brand posts, per Sortlist.

Roger Federer & Coco Gauff’s partnership lifted Barilla’s digital engagement by 71%.

Sprite saw a 30% spike with Trae Young, and Blue Coast Brewery gained 20% with F1 star Daniel Ricciardo.

So why the focus on male athletes?

AEO is analyzing shifts in male fan behavior and purchase decisions. Brommers pointed to a few distinct patterns in behavior between male and female sports fans:

Fans of men’s sports are less influenced by social content and more by the on-field performance.

They’re more likely to buy products directly used by athletes, not just those promoted on social channels.

In short, male athletes function more as aspirational buyers than influencers.

This is why brands like AEO are leaning heavier into sports like the NFL, College Football, College Basketball, F1, and Soccer in 2025. The opportunity lies not just in the size of the audience, but in how that audience behaves.

The road ahead for brands is clear:

✓ Tap into emerging leagues while staying loyal to the heavyweights.

✓ Go beyond logo placements.

✓ Build campaigns around athlete narratives, lifestyle alignment, and fan behavior.

And as AEO’s bullish moves show, the brands that understand this shift best will win big in the seasons to come.

The NBA Playoffs are more than a battle for the trophy—they’re a money-making machine. Host cities turn into cash magnets! Sometimes pulling in over $50 million from the spectacle. But it’s not just cities winning—teams strike gold too! With soaring ticket prices, merch flying off shelves, and blockbuster sponsorship deals. Sure, hosting comes with traffic jams and logistical chaos, but the payoff? Huge. From packed arenas to roaring bars, the energy is electric. The NBA Playoffs don’t just crown champions, they supercharge economies, unite communities, and deliver moments that last a lifetime!

Topgolf founders Steve and Dave Jolliffe have raised $34 million for Poolhouse, a tech-infused pool entertainment concept combining traditional pool with modern innovation. Poolhouse offers interactive games, upscale food, and craft cocktails in a vintage Las Vegas-inspired ambiance. With the global sports arenas market projected to reach $313.3 billion in 2025 and the pool table market growing at 6.50% CAGR, Poolhouse is well-positioned for success. Its tech-driven approach includes interactive games, social sharing, and a handicapping system, aiming to attract a new demographic and revolutionize the pool industry. Will Poolhouse succeed where Topgolf struggled? There is a chance.

Major League Baseball hit a home run in 2024, pulling in a record $12.1B in revenue, beating the NBA ($10.35B) but still trailing the NFL’s massive $23B. The New York Yankees, now valued at $8.2B, lead the league, while the Dodgers aren’t far behind at $5.6B. Average team values have grown 36% over five years, but that lags behind the NBA’s 101% and NFL’s 87%. Stars like Shohei Ohtani and a season opener in Japan are growing the sport’s global appeal. The league now boasts 40+ international sponsors, including Konami and Japan Airlines. With 71M+ fans attending games and over $200M from jersey patches, MLB’s playbook is working—but the race to catch the NFL is still on.

Did You Enjoy Today’s Newsletter? |