- ES Think Tank

- Posts

- The Buyout That Hits Home

The Buyout That Hits Home

October 2, 2025 | Edition #34

Hey there!

Sports used to be about winning. Now it’s about owning the game and the screen.

Take Amazon: it’s turning NBA nights into a Prime-time playground where fans don’t just watch: they bet, shop, and chase highlights live. Or Saudi Arabia: dropping $55B on EA to grab the controller and shape how millions experience FIFA, Madden, and beyond.

Two arenas, same story: the future of sports belongs to whoever controls the platforms fans can’t live without.

This week, we break down Amazon’s NBA moves and Saudi Arabia’s EA takeover.

Reading ES Think Tank for the first time? Subscribe and stay ahead of the trends shaping the sports business industry!

Amazon Prime isn’t just for binge-watching anymore. Starting October 24, it becomes the NBA’s newest broadcast home, turning fans from passive viewers into active participants.

In 2024, Amazon and the NBA signed an 11-year, $76B media rights deal, giving Prime Video 66 exclusive regular-season games, playoff matchups, and the NBA Cup finals. But the real play isn’t just streaming.

On September 30, Amazon raised the stakes, naming FanDuel the exclusive odds provider for NBA and WNBA games on Prime, creating a broadcast built to watch, bet, and shop all on one screen.

What makes “NBA on Prime” different

This isn’t just a game. You’re stepping into a live, interactive arena where you can:

🎯 Personalized bet tracking: Fans can connect their FanDuel accounts to see bets update live.

📊 Odds overlay: Optional spreads, props, and real-time odds layered into the broadcast.

🖥️ Custom multiview: NBA League Pass subscribers can stream multiple games at once.

🤖 AI highlights: Features like Key Moments and “Rapid Recap” surface big plays instantly.

🛒 In-game shopping: “Shop the Game” lets viewers buy NBA gear midstream.

Fact: You can’t place bets directly on Prime, but the strategy is clear: Amazon wants to weave content, commerce, and engagement within one ecosystem.

The strategy behind Amazon’s move

Sports remain cable’s last fortress. But Amazon is challenging that stronghold, turning basketball nights into a way to lock fans into Prime’s $139 annual subscription while creating new revenue streams.

Here’s the game plan:

Turn passive viewing into interactive fandom.

Funnel ad dollars, betting integrations, and merch sales into a single ecosystem.

Give FanDuel, already a $31B brand, exclusive reach inside NBA and WNBA broadcasts.

With ~220M Prime members and the NBA’s global following, Amazon isn’t just broadcasting games, it’s monetizing at scale for a $2.35T market. But every bold move comes with risks that could slow momentum.

The risks in court

Legal and regulatory challenges could complicate the rollout:

⏱️ Latency: Streams must keep pace with betting updates to avoid confusion. Amazon leans on AWS’s low-latency tools to minimize lag.

⚖️ Ethics: Linking wagers to broadcasts raises concerns about gambling normalization, especially for younger fans. Amazon emphasizes that features are opt-in.

📺 Over-commercialization: Too many overlays risk cluttering the game. Viewers can toggle them off, but balance will be key.

🏛️ Regulations: Sports betting laws differ widely across U.S. states, requiring careful compliance from Amazon and FanDuel.

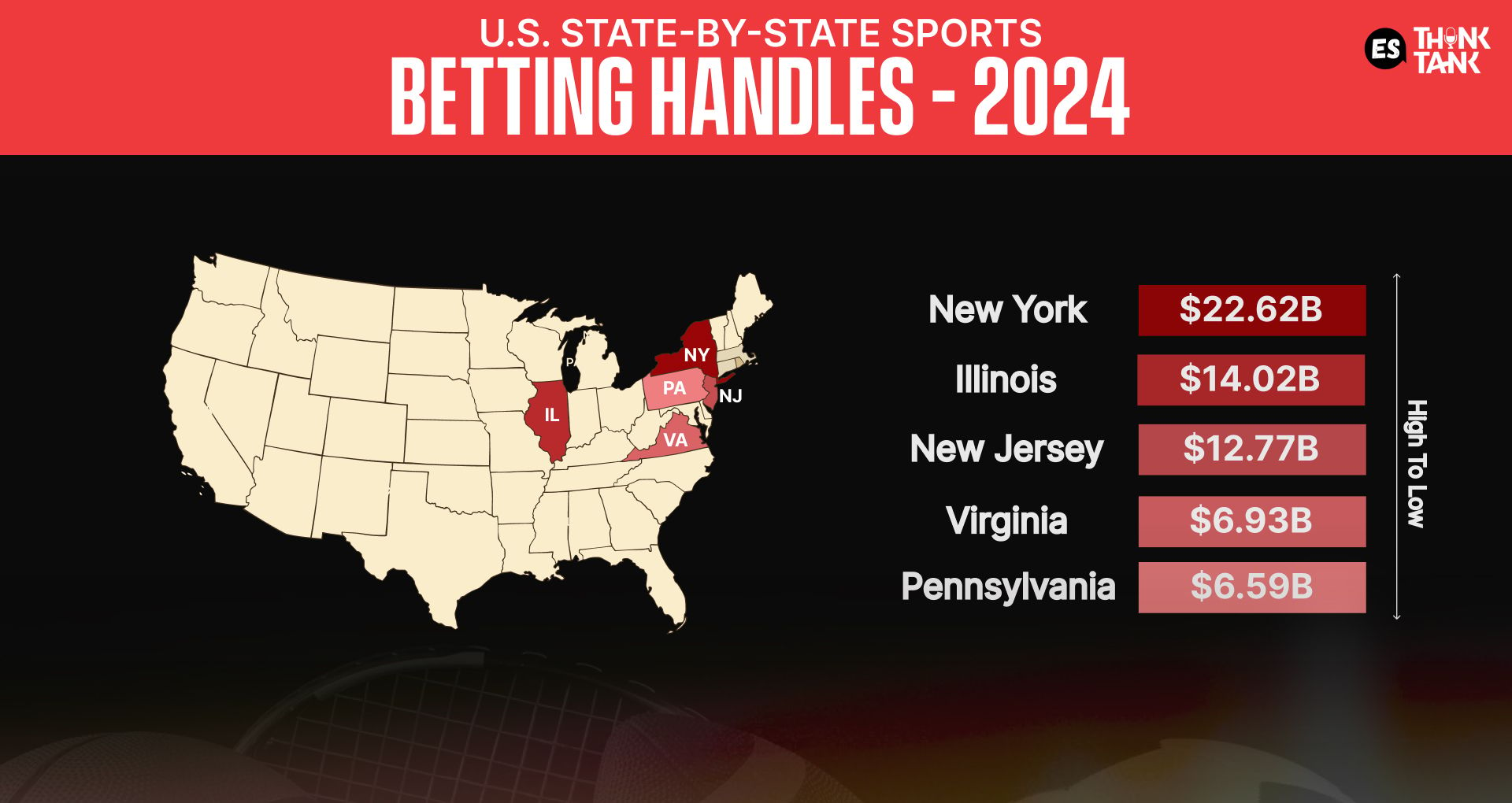

Despite these hurdles, betting in U.S. states remains extremely high:

The latest US Sports betting stats reveal that American football and the NFL dominate betting volumes in the US, followed by basketball.

The new sports arms race

Amazon’s bet isn’t happening in isolation. ESPN has already rolled out ESPN Bet integrations, while Apple, YouTube, and others are circling. Everyone is racing to blend interactivity into live sports because that’s the last stronghold of appointment TV.

For leagues, this shift carries new economics:

💰 New revenue-sharing opportunities.

👥 Deeper fan data and insights.

🌟 Expanded sponsorship visibility.

Broadcasts are no longer just about watching. They’re now platforms for betting, shopping, and real-time interaction. The real test isn’t adding odds or overlays; it’s whether fans actually want them. If they do, “game night” will never be the same.

Disclaimer: This content is for informational and entertainment purposes only and does not constitute financial, investment, or betting advice. Gambling can be addictive. If you or someone you know needs help, contact the National Problem Gambling Helpline at 1‑800‑522‑4700 or visit ncpgambling.org.

Do You See Amazon As the Future Leader of Live Sports Streaming? |

Saudi Arabia used to be “the oil kingdom,” its clout measured in barrels. But barrels don’t build soft power. Sports do.

The Public Investment Fund (PIF), Saudi Arabia’s sovereign wealth fund, started with obvious moves: buying Newcastle United, launching LIV Golf, signing Cristiano Ronaldo, and sponsoring Formula 1. Critics called it sportswashing 1.0—high-profile investments polishing an image while deflecting from political controversies.

Now the playbook has leveled up: a $55B takeover of Electronic Arts, the gaming giant behind FIFA, Madden, and Apex Legends.

Here’s the deal in numbers:

💵 EA stockholders: $210/share.

🔁 PIF rolls over: 9.9% stake.

🏗️ Structure: $36B equity, $20B debt, $18B at closing.

📅 Expected close: Q1 fiscal 2027 (pending approvals).

👥 Investors: PIF, Silver Lake, Jared Kushner’s Affinity Partners.

This is the largest leveraged buyout in history, dwarfing TXU’s $32B deal in 2007. But the real question isn’t about size. It’s about what happens when Riyadh holds the controller.

EA puts Saudi Arabia in control of global sports

Owning EA gives PIF something no football club or golf tour ever could ‘influence’ over how millions of fans experience sports on screens.

With EA under its belt, Saudi Arabia suddenly has the ability to:

Shape how global fans engage with sport through games and esports.

Steer youth fandom toward its leagues and players.

Lock in a long-term stake in the sports-entertainment economy.

Position itself as a digital-first innovator.

The timing matters. With slowing forecasts and fan fatigue, going private gives EA freedom to take risks in AI, live services, and next-gen platforms, while reshaping the licensing game.

The licensing chessboard

Sports gaming is powered less by graphics than by names, likenesses, and leagues. With PIF at the helm, licensing becomes a geopolitical lever.

Here’s what could shift:

Saudi Pro League could leap from niche to global spotlight with full rosters and exclusive features.

Madden & EA titles could emphasize new international markets, shifting how leagues and players negotiate.

Competitors like 2K, Take-Two, and Konami may face higher licensing costs or lose access to key rights.

For fans, that could mean new leagues highlighted, in-game promotions, or esports circuits tied to Saudi-backed priorities. Sports games become a chessboard, where influence may matter more than gameplay, making EA a suddenly hot target.

Why EA is too tempting to pass

EA is a money machine, fueled by recurring revenue from in-game purchases, downloadable content, and subscriptions.

Consider the numbers:

The model is simple: every game becomes an annuity. For PIF and partners, that’s not just investment upside; it’s digital sovereignty over sports entertainment.

And now that Riyadh holds the controller, the stakes extend beyond EA’s balance sheet. This is about whether the world’s most popular sports games remain neutral playgrounds or evolve into strategic assets advancing a global power agenda.

Because in sports, the scoreboard doesn’t always tell the full story. Sometimes, the real game is who owns the arena.

Visit our Think Tank Hub to explore insights, interviews, and more.

The 2025 Ryder Cup at Bethpage Black hosts 250,000 fans, $750 tickets, and $200M local revenue, powered by high-tech logistics.

Wall Street eyes college sports, but Power 4 conferences hesitate amid NIL, revenue-sharing, and billion-dollar media-rights opportunities.

58-year-old Tom Cillo signs first-ever NIL at Division III Lycoming, proving age is just a number, and impact isn’t measured by 6k Instagram followers.

Did You Enjoy Today’s Newsletter? |