- ES Think Tank

- Posts

- NFL Goes Global, WNBA Goes to the Table

NFL Goes Global, WNBA Goes to the Table

September 18, 2025 | Edition #32

Hey there!

Big bucks, big wins… but who’s really cashing in?

The NFL is leading the charge, with the Dallas Cowboys now valued at $13B and even its least-valuable team, the Bengals, worth $5.25B - well above MLB or NBA averages. Over in the NBA, player salaries are soaring too, averaging $13.99M a year.

But the WNBA tells a different story. Despite the league’s growth, players remain far behind their male counterparts, fueling louder calls for a fairer revenue split.

This week, we break down both sides of the scoreboard: the NFL stacking billions while WNBA athletes fight for the equity that could change the game.

Reading ES Think Tank for the first time? Subscribe and stay ahead of the trends shaping the sports business industry!

The NFL doesn’t just sell football anymore. It sells certainty.

While tech stocks wobble and crypto winters drag on, the NFL’s balance sheet only runs one direction: up.

Just ask the Dallas Cowboys. Last year, they became the first sports team to cross the $10B mark. One year later, they’re worth $13B - a 30% jump and more than double since 2021. That’s no longer “America’s Team.” That’s a Fortune 500 company in helmets.

And Dallas isn’t an outlier. The entire league is a fortress of value:

📊 Franchise Valuations (2025):

Floor: Every NFL team is worth $5B+

Average: $7.1B

Lowest: Cincinnati Bengals at $5.25B

By comparison:

🏀 NBA: Warriors top at $9.4B, Grizzlies bottom at $3.2B

⚾ MLB: Yankees top at $8.39B, Marlins bottom at $1.3B

The NFL’s floor is higher than other leagues’ averages. That’s not an accident. So how does the NFL league keep these valuations climbing year after year?

How does the NFL print money?

At the core: media rights and betting.

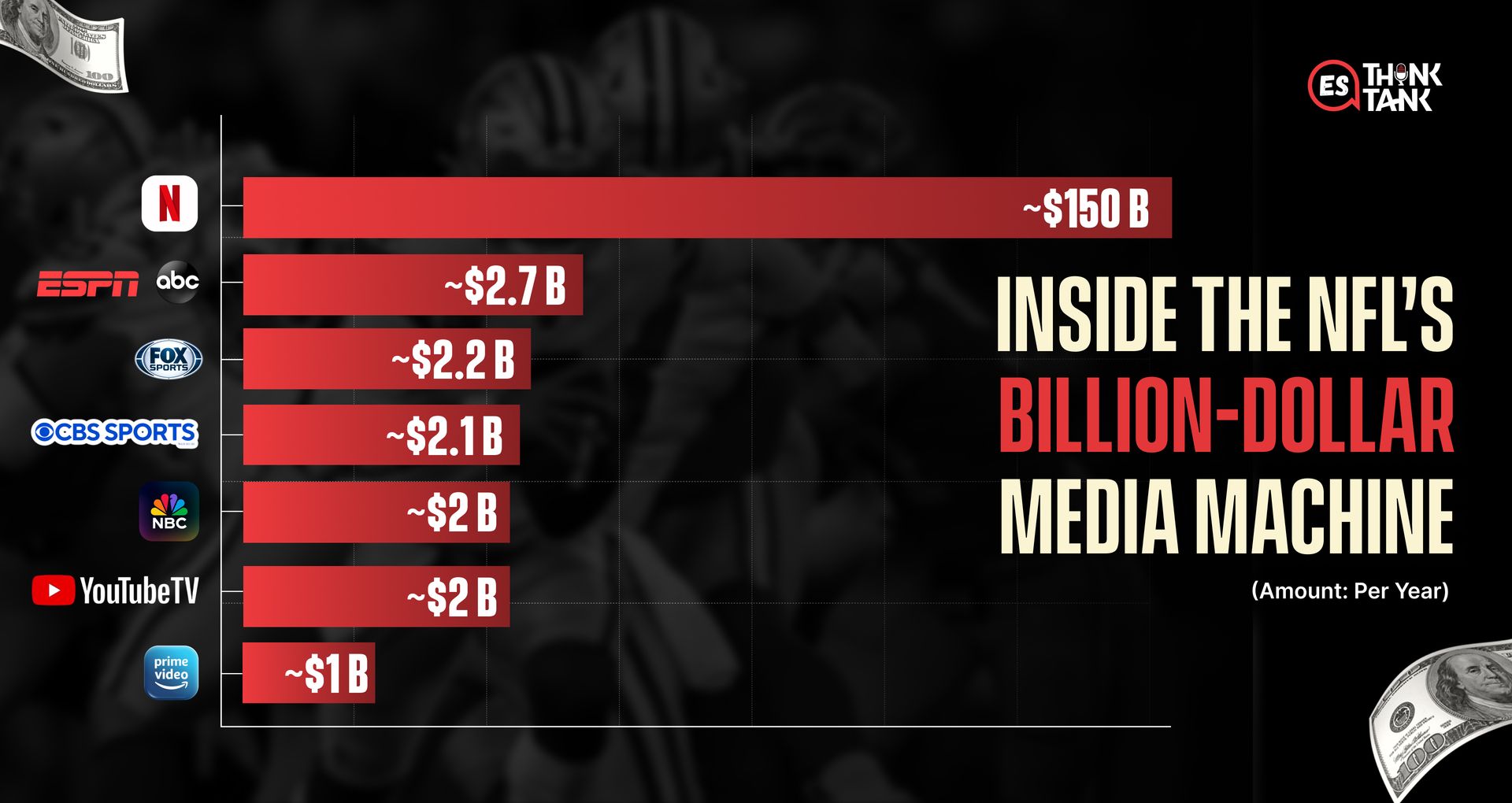

In 2021, the league locked in an 11-year, $110B deal spanning Amazon, CBS, FOX, NBC, ESPN/ABC, YouTube TV, and Netflix. That means billions per year guaranteed.

Check out here:

And that’s just one lane.

Super Bowl LIX alone drove $800M in ad revenue. And the momentum keeps building up.

In August 2025, ESPN acquired rights to NFL Network and RedZone, handing the league a 10% equity stake worth $2.2-$2.5B.

Then there’s betting.

Legal wagers on the NFL are projected to hit $30 billion in 2025, up 8.5% year over year. U.S. sports betting overall cleared $70B in the first eight months of this year.

The NFL isn’t just football. It’s recurring revenue, packaged like a blue-chip stock.

The NFL’s next market: Planet Earth

2025 marks the league’s boldest international slate yet: seven regular-season games across five cities: London, Dublin, Berlin, Madrid, São Paulo.

The play is simple: international fans don’t just buy tickets. They stream games, buy jerseys, and attract global brand sponsors. That fuels bigger media contracts, which circle back into franchise value.

Commissioner Goodell is already eyeing the next stage: “I do believe we can get to 16 games. Then you'd be in 16 different markets, or you might double up like...” The message is clear: the NFL wants to own Sundays everywhere, but what happens when American football truly becomes a global obsession?

Wall Street in shoulder pads

The old NFL was run by dynasties: Jerry Jones (Cowboys), Robert Kraft (Patriots). The new NFL is turning into Wall Street’s playground:

2023: Josh Harris buys the Washington Commanders for $6.05B.

2024: Rule change allows private equity firms to own up to 10%.

Firms like Arctos, Ares, Blackstone, and Carlyle are circling. Even ex-NFL players like Curtis Martin are investing.

The NFL has nailed what every business chases: certainty. Locked-in media deals, betting revenue on a tear, and valuations that make Wall Street jealous. Add international growth and private equity dollars, and the league isn’t just America’s game anymore - it’s plotting a global monopoly on Sundays.

The question isn’t whether the NFL can keep winning. It’s whether anyone else in sports can even keep up.

Every NFL Team Is Worth $5B+. Which League Feels Most Undervalued Right Now? |

WNBA players aren’t staying quiet anymore. 🗣️

NWSL players flashing “Pay them what you owe them” during All-Star Weekend. And the timing couldn’t be more critical.

With the league’s CBA expiring on October 31, 2025, negotiations are heating up, and the demand is simple: a fair share of the money.

The numbers tell the story:

🏆 Steph Curry: $59M/year.

📊 NBA Average (2025): $13.99M/year.

⭐ Kelsey Mitchell: $249K/year.

📉 WNBA Average (2025): ≈ $102K/year.

That’s more than a 100x gap between the top stars, and it’s not just about talent.

Since 2011, the NBA has operated under a near 50-50 revenue split, guaranteeing players roughly half of all Basketball-Related Income. The WNBA? Players take home less than 7% of league revenue.

That’s why WNBA athletes are pushing for the same deal: 50–50 split. And they’ve picked this moment for a reason.

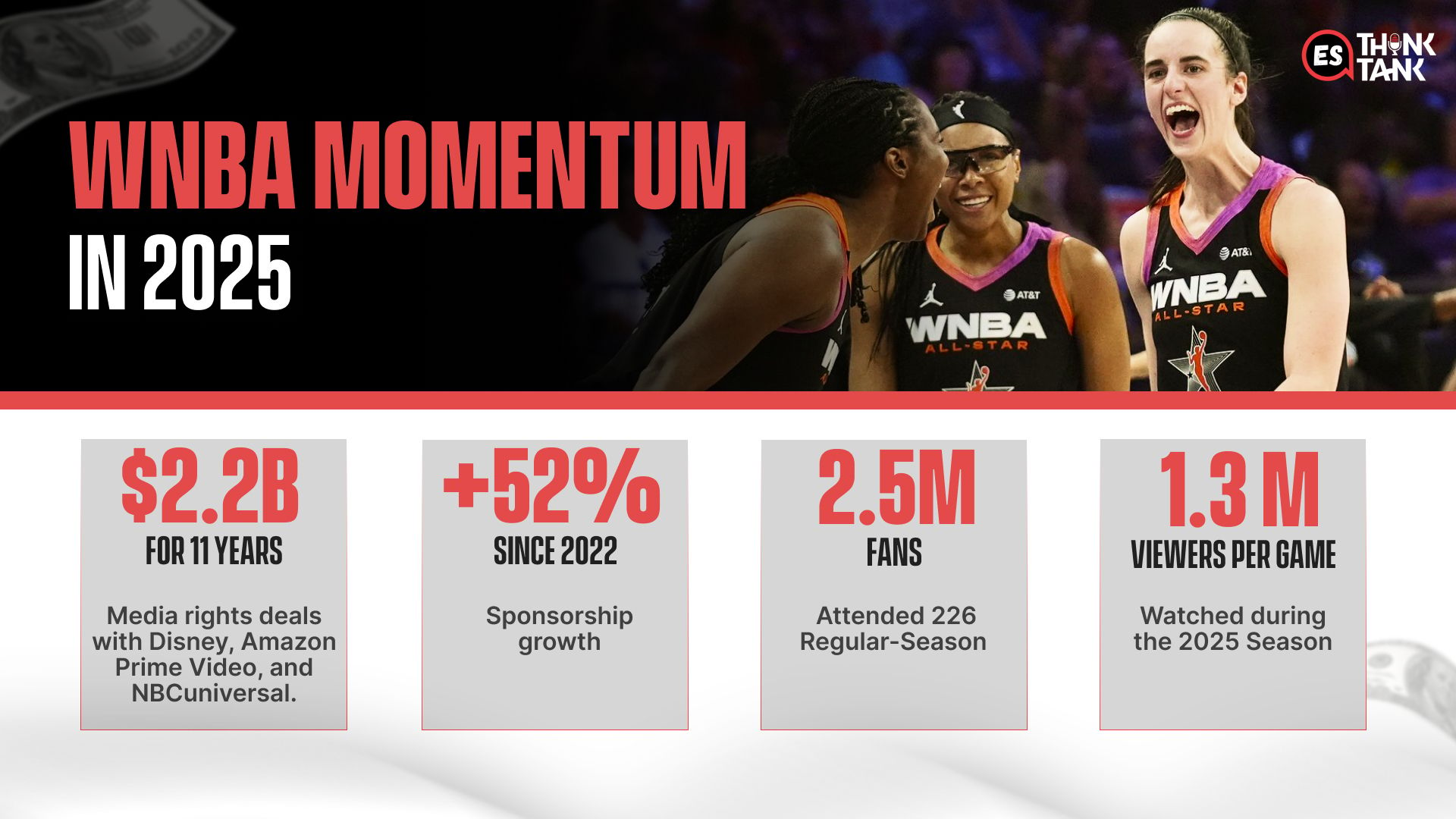

Because the league’s finally riding a money wave:

With bigger media deals, franchise growth, fan interest, and social engagement, the WNBA is making some serious noise. But here’s the million-dollar question: will a 50-50 split make it rain for everyone, or just leave some players chasing dribbles?

The upside of 50-50

If the WNBA adopted a true split, the math changes fast:

📈 Average salaries could climb toward $1.5M - nearly 10× what Caitlin Clark makes now and far beyond the usual 3% annual raise.

💎 Top earners could edge past $400K, a significant jump from today’s ceilings.

🏅 Minimums and rookie deals ($66K–$249K today) could leap toward $750K, finally making the league a full-time career path.

That kind of shift would keep stars from chasing 10 - 15× paychecks in Russia, Turkey, or Australia, while also making the league a full-time career at home.

And the timing is favorable: Nike, Google, Coinbase, and shiny new jersey patch deals are padding the bank, and the 2025-26 media rights renewal promises even more green. A fair split isn’t just about the Benjamins; it could keep stars home, bring in elite talent, upgrade facilities, and finally make those full-time meals a reality instead of a fantasy.

Still, the tension remains: owners, despite $500M invested over 29 years, agree that salaries need to increase again. But there’s a conflict over how much. So, why aren’t they fully on board?

The financial reality

The WNBA runs on a smaller revenue pool, around $300M in 2025 per Sportico, with higher per-player costs, making a full 50-50 split complicated.

Key pressures include:

⏳ Revenue Timing: Large salary increases before the new media rights deal ($60M/year) could destabilize finances.

💸 Financial Losses: The league lost $40M in 2024 on $180–200M revenue and hasn’t turned a profit since 1997.

🏗️ Expansion Costs: New teams in Cleveland, Detroit, and Philadelphia cost $250M each, adding major expenses. Adding another team further heightens this risk.

If salaries don’t start sniffing $1.5 million averages, those “We Are the Future” T-shirts won’t just be for warmups. Sure, a clean 50-50 revenue split could send the league soaring, but that’s a risky bet with players fiery enough to take their activism public, crank up the negotiations, and demand the receipts.

The next move isn’t just about money, it’s about who runs the whole show.

Visit our Think Tank Hub to explore insights, interviews, and more.

College football Saturdays are now on 24 streaming platforms, costing fans $111/month on average, threatening to break the game’s cherished traditions.

Seven months. $340 million. Unrivaled, the 3-on-3 women’s basketball league, is outpacing the WNBA, offering top salaries and player equity.

For the first time since 2016, an American luxury brand storms Formula 1- Cadillac joins in 2026 with GM backing and star drivers.

Did You Enjoy Today’s Newsletter? |